20221026

<Gold Market Review>Gold Rebound Appears, Advise to Have a Little Try

The US dollar index remained volatile and rose in October. Even with the Federal Reserve raising interest rates several times, the U.S. CPI data remains high with the CPI rising 8% year-on-year last month, which is above the 2% target. Even with the risk of a potential recession when facing high inflation, the hawkish stance does not appear to show any signs of faltering, as the main goal is to keep inflation down. At present, the market generally expects that the Fed will raise interest rates by 75 basis points at the meeting in November without any suspense. I believe that The US dollar will continue to be strong, driven by the premise of continuous interest rate hikes and the risk aversion of global economic recession.

After the release of the CPI data, the gold price rebounded from the bottom. It seems that the market has already expected there will be a 75-basis point interest rate hike in November. In fact, we all know that if the interest rate is too high, the economic growth will be limited, and debt will be increased. I believe that the Federal Reserve cannot afford to raise interest rates significantly for too long. Otherwise, there will be a bunch of problems for debt in the future, which is another difficulty for the Fed. Therefore, I personally think that the central bank will not raise interest rates indefinitely. Assuming that the CPI data will drop in the future, the Fed's attitude on interest rate hike will be reduced, and the subsequent two to three meetings on interest rate will determine the fate of the US dollar and gold. As of October 25, gold was stubbornly holding above the USD1,600 level, which shows that the gold bulls are quite strong. Once the Fed suddenly slows down the pace of rate hikes without warning, it will undoubtedly have an impact on the US dollar, and gold will have a strong rebound.

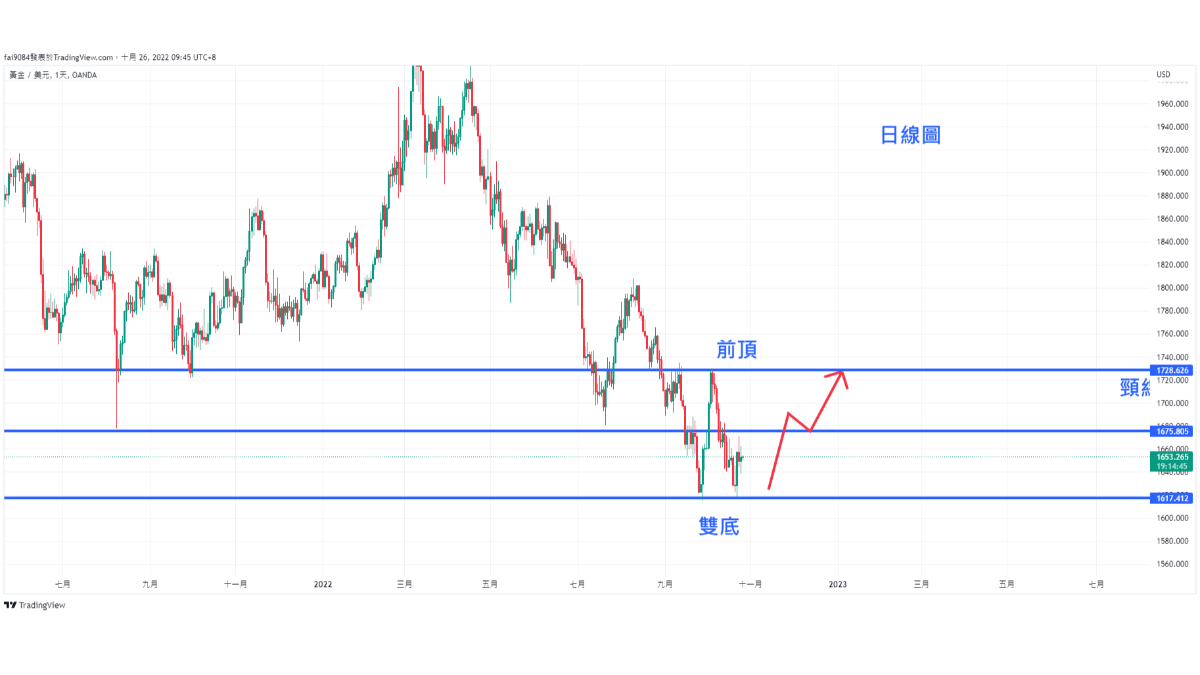

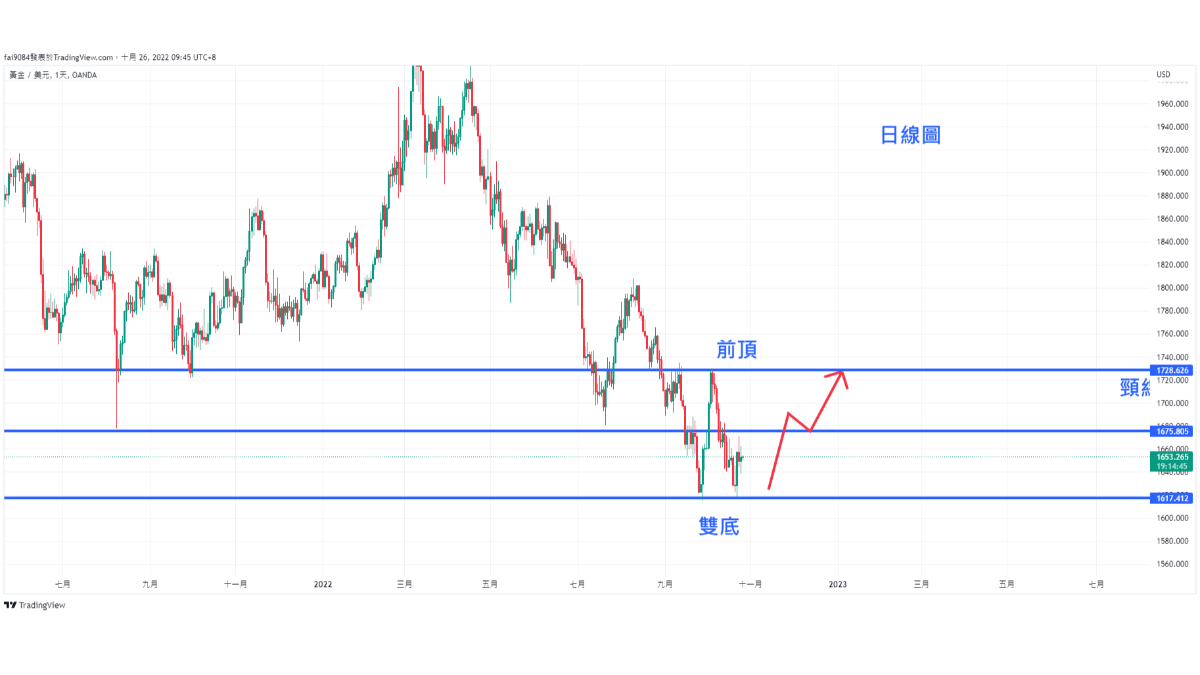

Technically, the weekly chart is in a rather awkward position, with support at 1,617 below and resistance at 1,680 above. Although it fell below the neckline in the early stage, there is no more downward trend in the follow-up, and the support of 1,617 below will have a chance to look after it breaks down. If it turns bearish, it must significantly rise through 1,727. Simply put, it is currently in shock and lacks direction. On the daily chart, the downward trend seems to have slowed down because there is no lower low for the time being. Since October 21, it tried to challenge the front bottom, and finally it has risen sharply by USD40 because of the Fed's dovish remarks. Thus, the downside is relatively conservative. In the four-hour chart, it is more obvious that the previous black candlestick was disappeared, and a double-bottom rebound pattern showed, which is a signal of technically standard upward. Whether it will resume its upward trend remains to be further confirmed. After all, it is always close to the 1,680 - 1,720 resistance above, and has broken the downward trend of USD1,641 in the short term, which shows that the short-term bulls have an advantage. Short-term investors can try a bit to see if the gold price will be rebounded to the position of 1,720 - 1,730. It is advised to stop loss when it reaches below 1,600.

Hugo Leong

Gold Analyst of Hantec Group

Daily Chart

Extended Reading

主席的信 :「同心抗疫,感謝有你」

BY Digital Marketing FROM Hantec Group

亨達30載系列 - 開拓高級紅酒市場 創立薇娜利雅國際貿易

BY Digital Marketing FROM Vinolia

<Fossils Talk>The August Birthstone - Olivine

BY Group Branding and Promotion FROM Hantec Group

Units B-C, 1/F, Wing Sing Commercial Centre, 12 Wing Lok Street, Sheung Wan, HK

(852) 2810 0332

No. 24, lane 102, An-He Rd. Sec. 1, Taipei, Taiwan

(886) 02-2755 1681